|

24/5/2018 0 Comments How to buy a software business like a BOSS! Step by Step advice from the experts at Flippa.com

Welcome to interview 3 in the software buying series on the Purposeful Products Blog.

We began the series with an overview of the common mistakes that business owners make when buying software to use in their own businesses, and what techpreneurs can do to make this process easier for customers. In this post, we’ll be looking at buying software as a ready-made business opportunity. You may have heard about people buying businesses and getting ripped off, or otherwise short-changed. There can be a lot of anxiety around making a wise decision and not having the “wool pulled over one’s eyes” when handing over hundreds, or even thousands when buying an existing business. Chris Holle - a marketing specialist at Flippa.com agreed to speak to me about this topic, so in this article, we'll take a deep-dive into how to buy a software business. We’ll bust some myths, and give you a blueprint to follow to help you tackle a process that for many, is just as nerve-wracking as hiring a developer to create software from scratch. Thanks so much for agreeing to be interviewed Chris. I’ve been looking forward to shedding some light on this topic, and helping people interested in this option to educate themselves about how to buy a software business the smart way. Please tell us about your platform. Flippa is a marketplace for entrepreneurs looking to buy or sell online businesses. We started in 2009 after being spun from our sister company, SitePoint. We noticed that people were posting on message boards and forums to sell their online businesses (mainly websites), which wasn’t very efficient or safe, and realized that we could create a marketplace that helped entrepreneurs buy and sell these businesses, and we established an MVP in under 24 hours! Fast forward to today, and we’ve had over $200 million in online businesses bought and sold through Flippa. That’s impressive! What do you see as your USPs over alternative ways to buy a business? Our biggest selling point is having more businesses for sale at any one time than other marketplaces, or brokerages may have in an entire year. Whether you’re looking for a website generating $20/month via Google AdSense, or an Amazon FBA business generating $500,000 annual profit, there’s a high probability that we’ll have several businesses for sale at any given time that meet your criteria. We’ve also greatly increased the amount of high-value businesses on our platform in the last 3 months by partnering with over a dozen different brokerages. The number 1 fear people have about buying a company is getting burned by a bad purchase. This could include overestimating the companies value and assets and buying a worthless, or very low value company at a high price, missing the signs, or being completely unaware of important points about the business that should have influenced the buying decision, (or given the buyer scope to negotiate a lower price) or maybe even handing over money and not receiving a business at all! What can people do to avoid these nightmare scenarios? This is definitely a fear when purchasing a business, especially through an online marketplace. While virtually all transactions on our site go smoothly, there are cases every now and then where people feel that they’ve been ripped off. If someone plans to buy their first business, there are three things that it is absolutely crucial to understand before placing a bid: 1. Understand how to value an online business Business valuations typically range on a 2-3x annual net profit basis. So, if a business generates $15,000/year in revenue and $10,000/year in profit, the business (on average) will most likely be worth anywhere from $20,000-$30,000. Factors that also influence the value are:

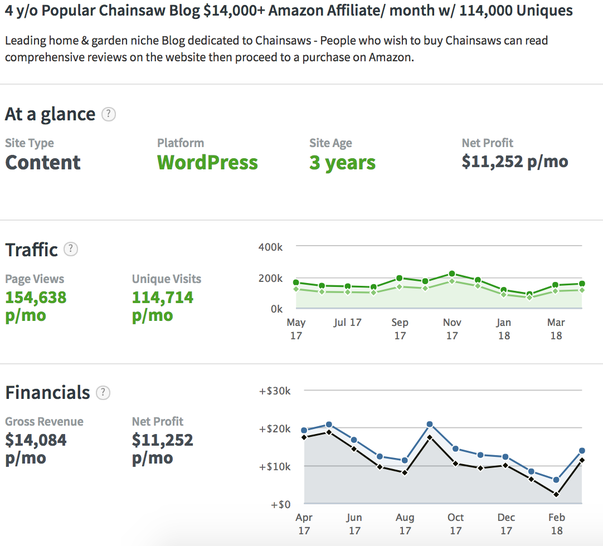

2. Understand due diligence If there’s one point that I could leave each reader with, it’s understanding how to conduct due diligence on an online business. Due diligence is the most important activity by far when buying an online business. We’ve put together a Due Diligence Checklist that new buyers should review before purchasing anything on Flippa. It covers the basics on conducting due diligence One of our top buyers on Flippa has stated that he spends roughly 5-6 hours reviewing a site, the financials, traffic, monetization, backlinks, etc. He mainly buys websites on Flippa, but the due diligence can (largely) be translated to other business types. We have a video which outlines his success story, and I highly recommend watching the full interview. 3. Make sure you know how to operate the business. This ties into the due diligence stage, but is a big factor in itself. Most of the time, people that feel scammed simply didn’t take the time to understand how the business operates. For example, if someone sees an eCommerce site making $1,000/month in profit and ends up winning the auction without performing due diligence, they may not realize that the owner spends 3 hours per day packaging and shipping the items, with another 2 hours per day running social media ads that drive traffic to the store. If the new owner doesn’t have the time to package and ship the items, or knows nothing about running social media campaigns, they may not be able to run the business as effectively as the previous owner. To sum this up, when buying a business, make sure you understand the value of the business, perform proper due diligence, and have the experience, or knowledge to run the business. Thank you! That information is gold. Unless you’re going to hire a competent person to manage the business for you, you must know what needs to be done, how often, and how to perform the essential activities needed to run the business to a high enough standard - otherwise things could unravel pretty quickly. Whether you have someone build your software from the ground up, or buy it, we’ll be launching mini-courses on different aspects of running a tech business soon, which in addition to reading Don’t Hire a Software Developer Until you Read this Book, will offer additional information and guidance for tech entrepreneurs. Bear in mind also that even if you buy your software business, unless you never intend to improve it, upgrade it, fix bugs, or perform other maintenance on the software, or the platform it runs on, you’ll still need to hire tech staff to help you! How do you help purchasers make informed decisions? What useful information and indicators around the Flippa site can you point out as examples? From the get-go, each listing has a quick screenshot of the revenue, profits, and traffic (where applicable). The first thing you’ll see on any business listing is this: Here we see a summary of the business, including:

We also require all sellers to add revenue proof to all listings that claim revenue. This is typically screenshots of their accounts (in this case a screenshot of Amazon Affiliates dashboard). This helps verify that the revenue is legitimate. Below this, we have detailed breakdowns of the traffic and financials. If a person has Google Analytics on their site, we have a plug-in that allows us to pull in all the site’s information, so a user can quickly see the verified traffic broken down by page views, visitors, traffic sources (organic, direct, social, etc.), as well as what countries are the top visitors. We really aim to provide as much up-front information as possible, so each seller can really show their business in the best light possible. This also helps the buyers, as it’s less work for them during the due diligence process. That’s great. I didn’t know proof of revenue was now required, and I like the fact that you’re pulling in this “real data” from websites. That would inspire confidence. I can also see how due diligence (in terms of the buyer’s capability) fits in here. You might ask: “Do I know how to manage the part of the business that relies on Amazon Affiliates to generate income?”, and “Do I know how to run a WordPress site?” and if not, there is a need to skill-up, and/or to start looking to hire WordPress specialists. (We’ll be interviewing a business owner whose company fixes WP sites soon!) You’ll also need to ask yourself if you even want to learn about these things. Be honest with yourself, and if not, you’ll need to think about hiring, or outsourcing, and whether the business can support the monthly amount you’ll need to spend to hire capable staff to take care of the things you don’t want to get involved with. Trying to run a business that you don't have a passion for is never a good idea. They need care, and attention to grow! What are the best ways to assess the “true value” of businesses? What are some key signs that a business is overvalued? Due to our auction format, businesses on Flippa tend not to be under or over-valued. Our process is much like eBay’s, where users place bids on businesses. This is perhaps the best method of assessing the true value of a business, as the market will dictate the price of the business. If the business doesn’t meet the seller’s reserve price, then that means it’s worth more to the seller to keep the business than to sell it. But surely some businesses must be undervalued? What about them? What are the more savvy and experienced buyers looking out for that others might miss? Businesses that might be considered under-valued, are typically ones where the seller either doesn’t have the time or knowledge to grow the business, resulting in stagnation (or possibly even a decline). The buyer then sees this as an opportunity for them, as they may have the time, or expertise to take the business and run with it. One of the best examples I can give is where a Flippa user bought a website for $1,250, and in two years was able to grow the site to generate $5,000 per month in revenue! We have the full case study here. The buyer quickly identified that this site had excellent Google search rankings... Simple but effective due diligence - Google the business, and see where it ranks! The previous owner was unable to capitalize on long-tail keywords, primarily to do with local search rankings. After using the buy-it-now option, he quickly transformed the site by targeting these keywords that were relatively uncompetitive, and due to the site’s original authority, it was quickly able to take over these markets. He also knew how to implement an additional monetization method, by adding lead generation forms and selling those leads. To sum this up, the best businesses to buy are the ones where you can use your knowledge and expertise to grow the business. [Here’s a link to a post about long tail keywords from Neil Patel, an authority on marketing and SEO.] Brilliant! Can you give us some “due diligence” tips to use when buying software in particular? I would say the biggest due diligence for software specifically is to test out the product, and see what you can do to make it better (if that’s your goal). Ideally, you’ll have the technical expertise to navigate around the code of the software to the point where you can make any changes or updates where necessary. Some SaaS businesses that have sold on Flippa require a hands-on person developing it. Others have been completely passive and haven’t required any changes to it and instead needed marketing expertise to come in to grow the business. Definitely. From my perspective, I'd advise that the buyer test the product, and look for issues (and opportunities).

Try and find out if there’s an up-to-date list of tasks to be taken care of, bugs to be fixed, and customer requests (or complaints) that has been maintained by the owner, or their team. This will give you an idea of the more tech-related jobs you’ll need to do in the first 3 to 6 months of running the business, in addition to sales and marketing, customer care, and other general management tasks. Are there any other important considerations when buying software, as opposed to other types of businesses? Just make sure you’re comfortable with operating that type of business model. If you’re buying a software business, you should either be experienced enough to make changes or updates to it, or have an employee or contractor you trust to make the changes on your behalf. Another suggestion would be to have the seller be available for questions for longer than the typical 3-month hand-off period. Many sellers (typically businesses selling for more than $10,000) are willing to hop on Skype calls to help the new owner adjust to operations. It might be in your best interest to talk with the seller and see if this can be extended, or if s/he can offer some time in the future to work with a developer and explain the product. This is not the norm, but is not uncommon either. Finally, I think it’s important to look at the reviews. Are people giving the product good feedback? Find out how this plays out and see if this is something you will need to invest your time in to improve, should you end up buying the business. Reviews can be a great source of data. If there are enough of them, it should be easy to do a SWOT analysis of the product based on:

If I'm buying a tech business, I'll need to be given the source code for the product(s) too. How would that work? My understanding is that they send all necessary files over (typically through Dropbox or Gmail) that the new owner would need. When buying a tech business, make sure to outline everything you need from the seller before placing a bid. Ok, well I would suggest the following:

You can download a PDF of the due diligence advice and the key points, and checklists, including the checklist I’ve provided above here. These are all excellent things to ask about, and to make sure you understand before making your first bid. Is there a formal process for handing over passwords, access codes and other important information? This process varies for each buyer and seller. Typically, it’s sent in a notepad file or word doc, but there really is no set way. For obvious reasons, it’s always important to change your passwords and financial information on each account prior to sending, or upon receiving access to these accounts. Thanks for mentioning that. So, Chris, how does one avoid coming across as a complete “noob” on the Flippa website?!!! A problem for many people new to Flippa is that they’re worried about asking the seller too many questions, and decide to not ask them. If you’ve never had control of a website or other business assets transferred to you before, it’s perfectly okay to talk to the seller about the process so you understand it more. By not asking questions, buyers risk missing very basic information that would have easily turned up in conversation had they asked. The most common mistake is buying a business and expecting it to run exactly as it was under the previous owner, but this is determined by how well the buyer understands the business and how to operate it. When buying a business, you should always feel comfortable with the state of the business before placing your first bid. Thanks Chris. No-one wants to come across as a pain in the behind, but get the information you need because you’re the one spending your hard-earned coin! What are some useful do’s and don’ts when interacting with sellers? I think just common sense stuff like being polite. And again, never be worried about asking too many questions. We’ve talked about testing the goods, in other words assets such as SaaS, or web apps, mobile apps, Chrome extensions, to see just how useable they are, how buggy they are etc. You could even sign up as a user, in some cases to see what the experience is like! If possible I’d also recommend asking for customer demographics etc., and confirmation of compliance with state and national regulations and now GDPR has come in, that too, if you want to serve, and manage the data of EU customers, or have clients who do. Not only will these give you a lot more information about the state of the business, but will also help with the smooth handover of the business. How much detailed information about a business can buyers get usually access to before the sale? As a buyer, you can expect to get nearly all the information upfront, excluding some confidential information that would be shared post-sale. This confidential information may include suppliers, or employee names, etc. Buyers might not give these details out for fear that a competitor is simply fishing for information. It shouldn’t be much of an issue for a seller to provide this information if it isn’t confidential. Never be afraid to ask! It’s the seller’s job to make you feel comfortable, and it’s your job to do the due diligence. If the seller refuses to provide the information you’re hoping for, it may be best to walk away. Is it common to acquire social media assets too, such as Twitter, Pinterest, Facebook, Instagram and YouTube accounts or channels, any banners designed for these sites, and all the existing followers as part of a sale? This is a very standard practice. Unless stated otherwise, it is pretty much implied that when you buy a business or website on Flippa, that you are getting all of the assets. Again, this is something to double check for during the due diligence stage, but only under very rare circumstances are social media accounts and other assets not included. What are some other things that buyers could reasonably expect to acquire as part of the sale? Some common items included in the sale are:

Thanks for those. If you’d like a checklist with ALL the things you should ask that have been covered in this post, you can find one here. What kind of contract, or agreement should I expect to have with the buyer? Sometimes a buyer will need to sign an NDA prior to buying the business. Many businesses for sale have an active audience, and if word got out the business was for sale, it could jeopardize their user base. Another common agreement is a support period provided by the seller. The length, and amount of time depends on what is negotiated between both parties, but having 1-3 months of post-sale support from the seller is fairly common, should the buyer have any questions on operating the business. One other agreement may be a non-compete. This is typically for sales $25,000 and up, and prevents the seller from using their knowledge of the business and industry to set up a competing business in the same space. For example, if you bought a software business that scraped emails from website, you may want to have the seller sign a non-compete that prevented the scraping of sites for emails, as they could develop another tool and market that same business using the information they already knew about growing the business in the first place. Who supplies these documents, and do I need to hire a lawyer? For most sales, a lawyer isn’t necessary. If you’re buying a business for over $100,000, it may be worth it to have a lawyer look everything over, and make any necessary amends, or additions. We do provide a template for NDA’s for sellers, but we highly recommend reading through it, and making changes to it as needed to ensure it is relevant to the business. What should a fair contract include, or exclude? What may be considered fair to one party, may be unfair to another. At the end of the day, both parties want the best deal for them, and that’s something the buyer and seller will need to work out together. At what point should I hand over my money? Only send the money once the auction closes. Most transactions will be through Flippa Escrow, which is by far the safest way to send money and gain control of the assets. The reason for escrow is the money isn’t released until the seller sends over the account information, and the buyer is able to take full control of everything. Once that happens, the funds will then be released to the seller. If you’re using PayPal, (which I really wouldn’t recommend for sales over $1,000) then talk with the seller, and make sure they are ready to send everything over before you send the money. While this goes without any hiccups for the majority of the transactions, there are transactions every now and then where things can go awry. The only way to guarantee a transaction going smoothly is to use Flippa Escrow. ESCROW is often used to protect the interests of the buyer and seller. I discuss it in my 3rd book, Don’t Buy Software for your Small Business Until You Read this Book in the scenario where a business has hired a software company to build a product for them, but it can also be applied to the successful fulfilment of software services, and for selling items, as it is in this case. How about red flags? What are some common warning, or danger signs when assessing a business, or the behaviour of a seller? If a seller doesn’t want to provide certain information, or doesn’t want to sign a non-compete, that should be a warning sign. None of this should immediately cause you to run, but it’s something worth looking into. If the seller doesn’t want to give you certain information about the business, it’s important to know why they’re doing it. Are they worried about revealing information to a competitor phishing for info on the site, or about someone finding out the site isn’t what it’s cracked up to be? As for non-competes, some sellers may operate similar businesses. This is something they should be disclosing upfront anyways, but if a non-compete might hurt other opportunities, then it’s not in their best interest to sign one. When cases like this arise, then as a buyer, I would go back to the seller and create a very specific non-compete form that directly pertains to the business I am considering buying. If that doesn’t work, it comes down to whether you trust the seller to not compete directly, and if that’s a risk you would be willing to take. Can you complete the sentence, “Run like hell if ………………”?

… the seller wants to do a deal off-platform!

Obviously, it’s in our best interest if a deal remains on our platform so we can collect the success fee from the seller, but as a buyer, the risk of being scammed skyrockets when you go off platform and there is no real upside. By remaining on platform (and subsequently using Flippa Escrow), the chances of being scammed are virtually zero, provided you perform the proper due diligence. Ah. I've discovered that the seller is in a different country to me. How does this affect the process? People buying and selling websites may be located all over the world. Since the majority of these businesses are location independent, it’s common for people to be in different countries. The biggest barrier is usually language. But with translation services, etc. this is greatly diminished as a problem. Is there anything I should have asked you, but haven’t? ;-) I can’t think of anything... you’ve been very thorough! Thank you! What advice can you give to readers if they buy a business and things go wrong? The first step is to identify why it went wrong. Once you understand what the problem is, reach out to the seller and ask for their advice. This may, or may not be included as part of the deal when buying a site, but whether it is or not, most sellers are willing to spend a bit of time to help you out. Many of these businesses only had one prior owner and despite the fact they sold the business, they do want to see it succeed. If you can’t seem to “right the ship,” so to speak, it may be best to chalk this up as a learning experience and list it back for sale on Flippa. If you do this, it’s best to be very open that you bought the business and it hasn’t worked out for you for reasons x, y, and z. As a seller, it is always in your best interest to provide as much information as possible, and just because it isn’t working for you, that doesn’t mean it won’t work for someone else. Can you tell us about any software purchases on the Flippa site that have become success stories? In 2017, one user sold his SaaS business for $70,000. The business was a global wedding planner and invite list, and was quickly taking off. The original creator and seller, Ben, sold the business because he had no time in his life to run the business, and as a result had stable, but not growing, revenue, despite the excellent functionality and feedback the product was receiving. A nice payday indeed! What else can readers learn about the process that smart buyers follow? Due diligence, due diligence, due diligence! Thanks so much for taking the time to talk to me Chris, I think people are going to find this post incredibly useful! My pleasure! Thank you so much for reaching out. Where can people go to find out more about Flippa, and how to get started with buying a business? To get started, simply go to Flippa.com to create your account. Once you’ve done that, I would recommend browsing our Editor’s Choice section to get an idea of some of the businesses for sale. Once you know what you’re interested in buying, you can search for your ideal business by refining your search criteria. Good luck! ☺

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

WHAT INFORMATION WILL YOU FIND on THE PURPOSEFUL GROUP BLOG?Want to build a mobile, or web app to offer to your existing customers? Archives

February 2024

CategoriesAll # Building Software Applications Business Life / Managing A Business Buying Software For Your Business Entrepreneur Interviews Series 1 Entrepreneur Interviews Series 2 Funding Marketing Mindset Productivity Automation Business Tips Productivity-automation-business-tips Productivity Process Automation & Business Tips Research & Publications Startup And Small Business Support Technology Techpreneur Interviews Vision Strategy & Planning X |

|

Address:

5-7 Buck Street, Camden, London, NW1 8NJ Copyright © 2024. Purposeful Group®. All Rights Reserved.

|

Email: courses[at]purposefulgroup.com

Telephone: UK: 0203 974 2225 |

RSS Feed

RSS Feed